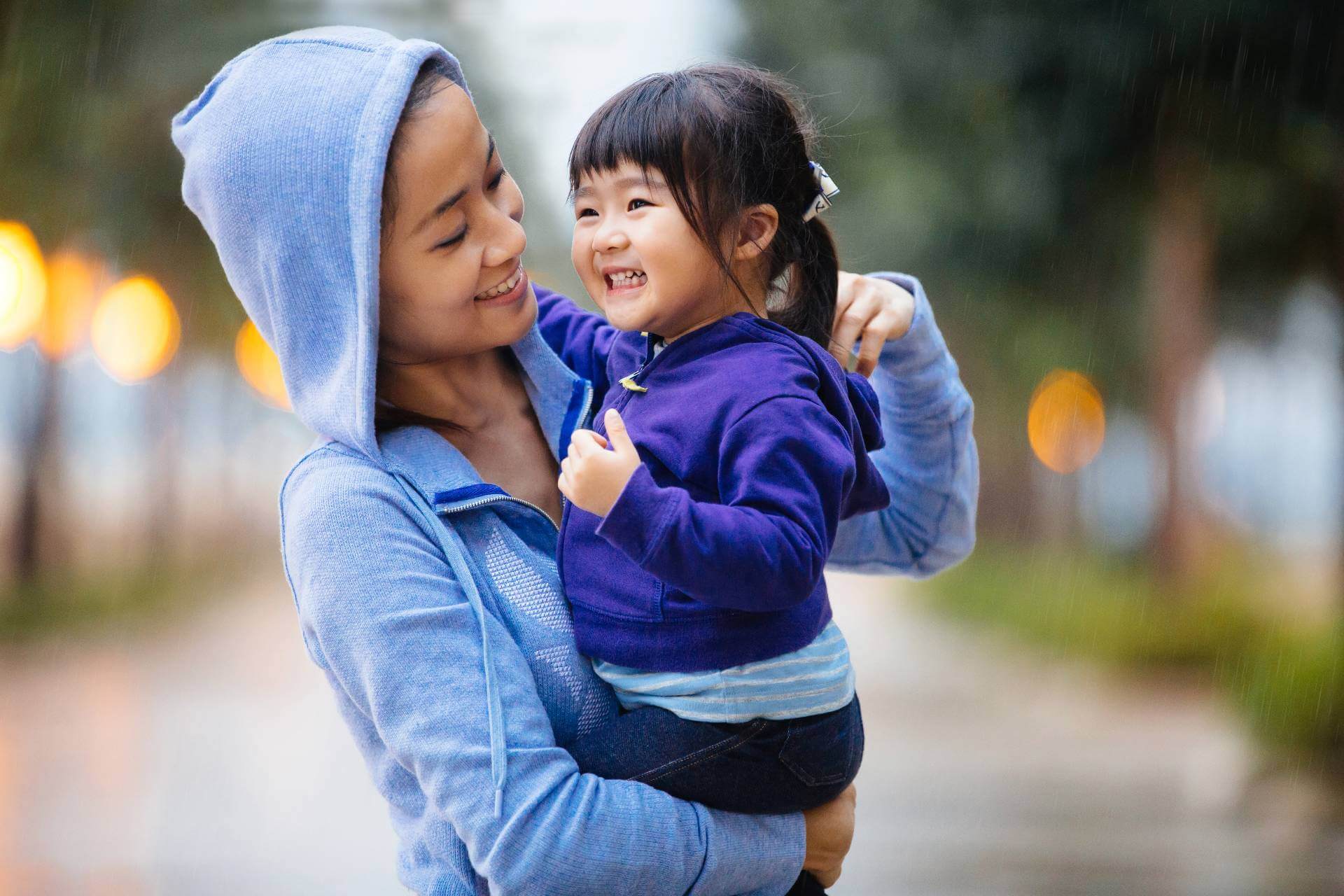

By purchasing life insurance for a child or a grandchild, you provide coverage that protects them financially now and later. They’ll be covered now, regardless of any potential health changes that may prevent them from qualifying for protection later in life. Your gift will allow them to live their lives to the fullest and maintain a policy.

![]() Give the gift of life insurance

Give the gift of life insurance

This year, instead of buying your loved one a gift card, air fryer or Bluetooth speaker, what if you could tie a bow around peace of mind? Giving the gift of a life insurance policy from Legal & General America (LGA) is making a promise to cover that special someone for years to come.

Can you give life insurance as a gift?

Absolutely. You can gift a life insurance policy to another person to cover their life or you can transfer your own policy to them so they may be the owner and beneficiary.

Here are a few occasions and milestones that are perfect for gifting life insurance:

The purchase of a first home | Births and adoptions | Graduations | Weddings | Birthdays | The holidays | Starting a new job | Just because it’s Tuesday

Buying a policy is almost as easy as shopping online

If you’re purchasing life insurance for a minor:

In general, to get coverage for a child you'll need to provide their personal information, such as name, date of birth, address, and Social Security number. Your responsibility is to make regular premium payments to keep the policy active until the child reaches adulthood. After that, you can transfer ownership of the policy to them or continue to take care of the policy for them with their permission.

At LGA, you can add a child rider to your term policy to cover your children from as early as 15 days old to 18 years. This policy can be converted into their own policy after they turn 20. Learn more about our life term insurance riders.

If you’re purchasing life insurance coverage for a parent or another adult:

You’ll need their consent to buy protection. Since the owner and the insured don’t have to be the same person, you can offer to pay for their monthly premiums throughout the duration of the policy.

The beneficiary of their life insurance can be anyone they want: children, parents, or you. Keep in mind, a life insurance company will only allow you to buy protection for someone whose passing will have a direct impact on you, such as a relative, a romantic partner or business associate. Important to reminder that gifts like these may have tax implications.

Transferring ownership of your life policy

As the owner, you can make someone else both the owner and beneficiary of your coverage. When you pass away, the new owner will receive the full cash payout. Transferring ownership usually happens with permanent policies, such as universal life (UL) insurance. It’s important to mention that you may need to keep contributing with premiums after the transfer to maintain the policy in force. You’ll want to talk with your insurance advisor about the transfer details of your policy.

Benefits of giving someone a life insurance policy

Life insurance coverage is the gift of a promising future. Here’s a list of ways you can transform someone’s life by gifting them a life insurance policy: