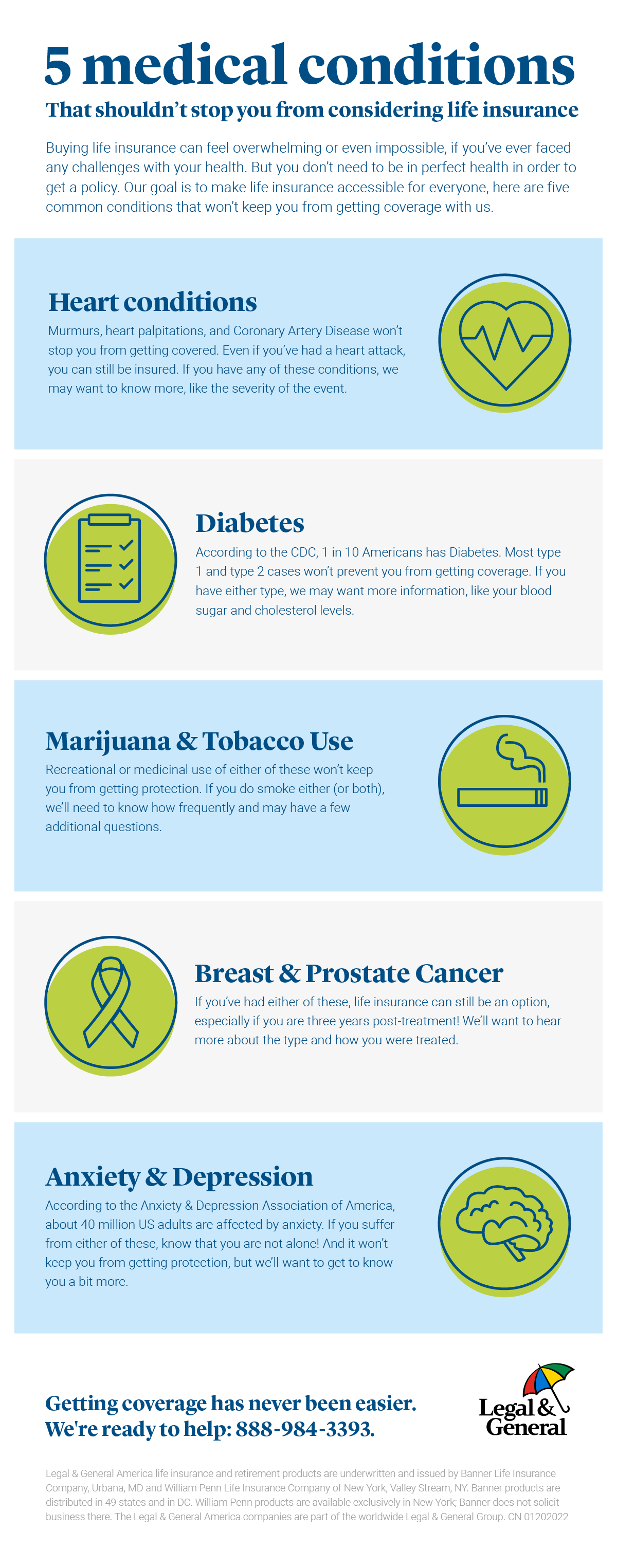

Life insurance with pre-existing conditions

So wait, you're not perfect? That’s okay — turns out nobody is. But you can most likely still get affordable coverage.

Let’s face it, we all have issues. And if Covid-19 has taught us anything, it’s the importance of taking care of ourselves — physically and mentally — and taking care of the ones we love. But what about the health issues and medical conditions that you may already have or have no control over? It’s estimated that up to half of all non-elderly people living in the US have some sort of pre-existing health condition. If you’re among this half of the country and are in need of life insurance, there’s a good chance you can still get the protection you and your family deserves.

You can still get life insurance coverage with these five pre-existing medical conditions.

Heart conditions

Having a condition like a heart murmur, heart palpitations or coronary artery disease will still allow you to get life insurance coverage. Even if you’ve had a heart attack, you may still qualify for insurance. A life insurance company will want to know the severity of the condition and if the condition has been treated, is under control or if there are other underlying health issues associated with the condition.

Diabetes

According to the Center for Disease Control and Prevention, 1 in 10 Americans has diabetes. The good news is that most type 1 and type 2 cases won’t prevent you from getting coverage. If you have either type, a life insurance company may want to learn more from you, including your blood sugar and/or cholesterol levels. They’ll also want to know when you were diagnosed (a diagnosis later in life will give you a better chance for coverage).

Tobacco/marijuana use

Recreational use of tobacco and marijuana won’t keep you from getting protection. If you do use either (or both), a life insurance company will need to know how frequently. If you use marijuana for medicinal purposes, they’ll also want to know the condition(s) that it’s being used to treat.

Breast and prostate cancer

The medical world has made incredible progress in diagnosing and treating these common cancers. If you’ve had either, life insurance can still be an option — especially if you’re three years post-treatment. An insurance company will want to hear more about the stage and grade of tumor plus how you were treated (chemotherapy, radiation, surgery, or a combination of treatments).

Anxiety/depression

According to the Anxiety & Depression Association of America, about 40 million US adults are affected by anxiety. If you suffer from either or both of these, it’s important that you first you get the help you need. And second, know that you can still get the life insurance protection you and your loved ones deserve.

Use your medical treatment to your advantage

If you’re taking steps to stay healthy and actively manage your health conditions, life insurance companies will take that into consideration when they calculate your policy rate.

For instance, maybe you have a heart condition, but you’ve been controlling it with proper medications for years. Or maybe you’ve lived with diabetes your whole life and can show that your blood sugar is under control with recent labs. Any documentation of effective treatment and regular doctor checkups could help you get lower life insurance rates.

Recreational marijuana use? It’s all good.

Below is a sample to show how typical marijuana habits can affect monthly insurance prices with us. Our example is a 30-year-old man in excellent health applying for a $500,000, 30-year term life policy.

- Twice a year or less: $29.74 a month

- Two to three times a week: $38.66 a month

- Four times a week: $70.12 a month